When Personal Finance Accounting Gets Too Much!

This post is the third of a four-post series about tracking our expenses, courtesy of the #MaishaNiMPesaTu promotion. Read the introduction to the series, where I make a big confession, and the second post sharing my reflections after a week of closely tracking my expenses here.

There is no doubt that tracking your expenses is one of the most important tenets of good personal financial management. Money has a way of just disappearing – you get paid at the end of the month, pay bills and by the 20th, your account is running on empty. Where did it all go? Or you are doing your tax returns in June like we all did, and you look at the “Net Pay” line on the P9 form the accountant gives you, and you are certain you did not earn that much money!

Where did it all go?

To be great at managing our finances, we have to know where it goes. Tracking your expenses is great for many things:

- It tells you if your values are truly aligned with your actions. You spend money on what you value, and often our expenses are very different from what we say we value. This is why our budgets fail, because they are based on the person we wish we could be, and not who we truly are. Expense tracking gives you that reality check. It also removes the conflict from your budgeting process.

- It helps you know exactly how much you have available to spend. If you use a good expense tracking app, you start by setting spending amounts, and each time you record an expense, the balance available is displayed. This reduces the chance of accidentally overspending.

- It controls impulse spending. Expense tracking is like having a digital accountability partner. If you know you will record it, you hesitate before spending the money.

- It helps you control your money. You cannot measure what you do not know. Expense tracking helps you tell your money where you want it to go, and what you want it to do.

- Finally, expense tracking helps greatly with goal setting. At the touch of a button, you are able to tell how well (or how badly) you are doing on achieving your goals. You can accelerate some goals, or delay others.

The problem with expense tracking

I wish expense tracking was fun and easy, but like all habits, it is not. Starting off, we face a number of difficulties:

- We often do not know which is the right app to use,

- or even whether to use an app or a notebook,

- we keep forgetting to record expenses, and

- we do not know what to do with the information.

To complicate matters, we do not know how much detail is sufficient. For this reason, we keep thinking we “should” track expenses but never get to actually doing it. When it starts to get frustrating, then it is too much. The solution, however, is not to abandon the mission, but to get tools that orient to your habits.

First, start simple. Instead of going into a lot of detail, you could choose to start with just a couple of categories. Do not overthink it. A beginning template could have the following categories:

- Rent and utilities

- Meals and entertainment

- Personal care

- Household supplies

- Giving

- Incidentals

This means you are not stressing too much to start with, your focus is to get the habit going. In terms of tools, do not sweat it. You could use a notebook, a mobile app, or even Excel. With time, you can extend the categories, and the possibilities are endless as you can see in the replies here on where wine should go.

Expense tracking peeps. Is wine “groceries”, or “eating out”?😂😂😂

— Lady Tweetmouth (@RookieKE) August 10, 2018

Secondly, do not track expenses endlessly. The purpose of expense tracking is so that you can use that information for decision making – be it to formulate a proper budget or to reduce expenses. Every weekend, spend some time reviewing your expenditure and checking how you feel about it. Set spending goals and review to see how well you score.

Third, you will fail. Like all habits, you will sometimes end up with more money in theory than you have in your wallet, and the whole expense tracking thing will feel pointless. Do not give up. The beauty of personal finance is that every new week/month gives you an opportunity to start afresh. When you realize you have lost track, adjust your balances to the current balance and keep tracking. You will get the hang of it with time.

Finally, celebrate small wins. Set milestones and when you hit those, spend some time patting yourself on the back for doing well. As my mother likes to say, “encourage yourself”. It is a good practice.

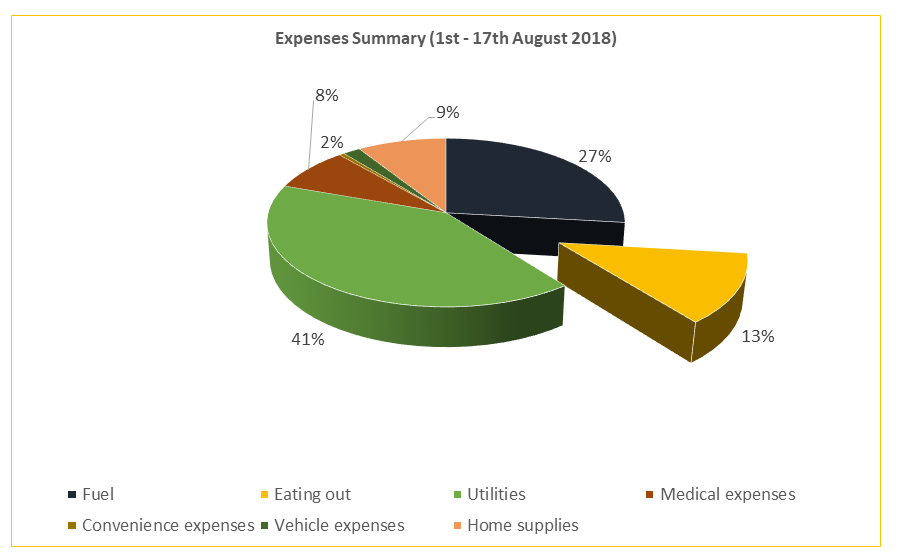

Onto my expenses update. This week wasn’t too bad as you can see below. My utilities make up the largest chunk of my spending, followed by fuel, and then that pesky eating out bill. In the last week I managed to not eat out as much (bless), I only had one lunch with the family over the weekend. The one difference between the Excel method and the app is that the weekly review is really helping me control my spending, unlike the app where I mindlessly recorded my expenses – sometimes doing it in bulk at the end of the month.

This post and subsequent posts on this series are sponsored by Maisha Ni M-Pesa Tu, a promotion by Safaricom, where Safaricom is looking to give away 7 apartments, over Sh110 million worth in daily and weekly cash prizes, and over Sh100 million worth of data, SMS and airtime prizes to M-Pesa users. What I like about this promotion is that I do not need to do anything to stand a chance to win, other than use M-Pesa for transactions, as usual. Follow the conversations on Twitter using the hashtag #MaishaNiMpesaTu