Our Kenya Airways Shares; Now We See Them, Now We Don’t! (Part I)

I will tell this Kenya Airways (KQ) shares story in two parts. In the first part, I will explain what happened to our dear KQ shares during the recent restructuring that culminated in the resumption of trading on 29th November 2017. In the second part, I will illustrate the impact and in the spirit of sharing personal experiences – both follies and ‘wisdoms’ – give my personal trading actions around the events.

Since the onset of its mega losses, the KQ shares over the three or so years preceding November 2017 traded somewhere between Ksh. 4 and 7. By the time Michael Joseph was appointed Chairman and talk of the restructuring set in, the share was more firmly in the Ksh. 5 zone.

Following what must have been very intense negotiations between the main parties involved – but of course, excluding you and me who owned some scrawny piece of the pie – a deal was finally hammered. Whether by design or because that is what happens when the public is an inconsequential minority, very little of the details of the deal was covered in the regular media.

Everything appears to have remained formal, with an Extraordinary General Meeting (EGM) then scheduled to approve the deal. A 41-page circular to shareholders was issued on 16 July 2017 giving the details of the proposal and notice of the EGM to be held on 7th August 2017. To further underscore our insignificance even as we were invited to vote on the matter, the Chairman in his letter included in the circular stated: “In addition, shareholders representing over 56% of the issued and outstanding Ordinary Shares have indicated their intention to vote in favour of the Resolution at the EGM. Such Shareholders include the Government and KLM.” ☺

So “we” approved the deal at the EGM and by the time the share was suspended from trading on 15th November to facilitate the coming into effect of the restructuring, our share was trading roughly at Ksh. 5. Needless to say, most of us had not yet caught up with the above circular and had no clue what the details of the deal were. When the shares resumed trading on 29th November 2018, no one seemed to know what to expect. A trade was done at Ksh. 2 and another one above Ksh. 15! But that is part two of the story. Here is what happened in the restructuring.

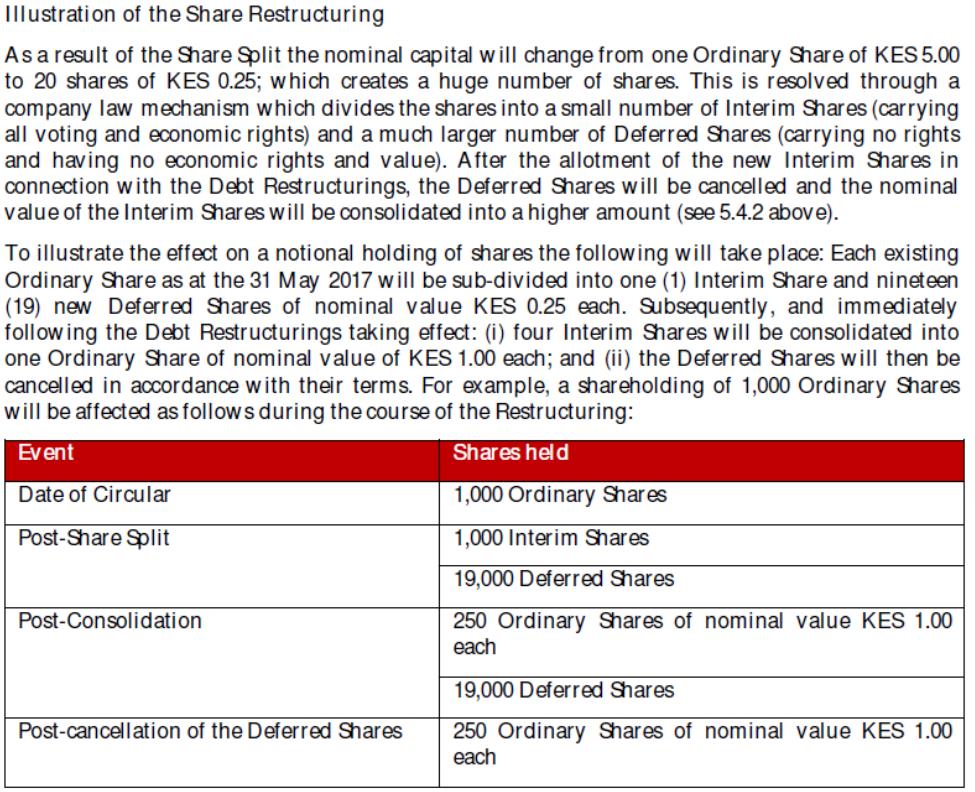

First, the existing shares were split in the ratio of 20 for 1. Then for every 20 shares, 1 share was designated an Interim Share and 19 were designated Deferred shares. Legalese and process notwithstanding, the 19 Deferred Shares are destined for cancellation – flushing down the loo basically. All the remaining Interim Shares, 1,496,469,035 of them would then constitute 5% of the company’s post-restructuring shareholding, while 95% or 28,432,911,665 new shares would be allotted to the participants in the new deal. The resultant shares were then consolidated in the ratio of 1 for 4 to result in the shares you found in your CDS account on the morning of 29th November 2017.

To the Board’s credit, the Circular to shareholders very clearly explained this as shown in the excerpt below:

So if we woke up to a shock when the shares resumed trading, we truly must blame this on our ignorance. We should have done the responsible thing to look out for the terms of the deal and we would certainly have landed on the circular somehow. Despite its technical content and non-inviting length of 41 pages, we would have at least caught up with such details as the Ksh. 2.13 implied conversion price for the loans that were becoming shares in the deal. This would have signaled to us the expected dilution of the market price that had been about Ksh. 5 before the deal. This then meant that assuming the conversion price was the new determined actual value of the KQ shares, while Ksh. 5 was our speculative price, the expected trading price for the share after the 1 for 4 consolidation should have been around Ksh. 8.50 ( Ksh. 2.13 x 4).

On the other hand, for those of us who had bought the share pre-deal at about Ksh. 5, our expected post consolidation price to leave us where were would have been Ksh. 20 (Ksh. 5 x 4). The trade that happened on the floor at 2 bob on 29th November indicates someone may not have factored in the consolidation but was aware of the conversion price. The high figure towards 20 on the same day also means someone expected the market to maintain its pre-deal valuation. But in its wisdom, the market finally settled somewhere between the 8.50 and 20, and has touched a low of 9.90 and a high of 18.50 since that first day of uncertain trades.

In the next piece, I will simplify this by illustrating what all this meant in value terms to someone who held 1,000 shares of the company before the restructuring and is still holding “them” (in quotes because they are now 250).

3 Comments