My Mom’s Budget Lesson That Stuck

Yesterday was Mothers’ Day, and as I was reflecting on my relationship with my mother, I was reminded of a small thing that mom did for us, that probably shaped how we view money in adulthood.

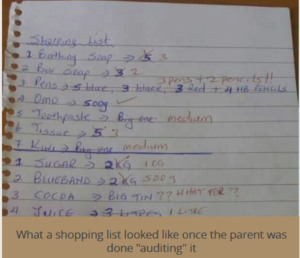

Like most Kenyan children of our time, our parents sent us to boarding school. A key feature in a boarding school child’s life was when you did “back to school” shopping, typically a day or two before school re-opened. The process involved you (the child) drawing up a list of the things you needed, plus some luxuries (we called these “grub”, typically sugar, margarine, drinking chocolate, cereal, powdered milk etc).

The list would then go through an “audit” process, where the parent would take a (red) pen and drastically reduce the items and amounts you asked for.

Image Credits: Kuirab

To navigate this process, we learned to inflate what we needed. We would also look over her shoulder as she trimmed the list, arguing our case as our beloved shopping list was slashed. These tactics ensured that we ended up with a reasonable quantity of essentials and some grub. We never got Weetabix and milk powder, that was for the rich kids.

My mom found a way to tame these tricks and to save herself endless arguments about how much shoe polish was enough for a term. Instead of asking us to write shopping lists, she allocated us an amount.

I remember when I was 12 (Standard 7), my allocation for the term’s shopping was Kshs 1,000. We would then go to her shop (she had a retail shop), check the prices, and try to fit everything we wanted and needed within that 1,000 bob. It was a sufficient amount for the essentials and some grub if you planned well.

She would then give the “budget” a once-over to make sure we had not left out any essentials, with the intention of writing home to ask for them, then she would give us the money to go shop at her shop – key business lesson here on not mixing business money with personal money.

This seemingly innocuous thing that mom did taught me a number of things at an early age:

- It enhanced a lesson about the value of money. Having a budget amount to work with meant that we learned very early that money is always a limited resource that should be used wisely.

- It was a lesson in stewardship. Children are generally wasteful, because they do not feel the effect of waste in their daily lives. This was especially so in boarding school. By giving us a budget to work with, mom was teaching us how to use our stuff wisely. I remember saving on shoe polish, because I would use my large tin so carefully that it would last 2 school terms, instead of drinking chocolate, I would go for cocoa, which lasted longer. Knowing that I sacrificed grub money to get pens and pencils, I would be careful to use them till the last drop of ink.

- Priorities. With the older method, she decided what was important, and that’s what would guide which items would be struck off the list. By putting this in our hands, we quickly learned how to prioritize our wants and needs, and adjust our financial plans accordingly.

- Squeezing in some fun, even when the money is short. As mentioned, 1,000 bob was not much, but with the right planning, you could get sugar, margarine and fruit juice, which were the grub basics. But you had to really plan eh.

These lessons have stuck till now, and I think even parent should consider using this method to teach their pre-teens and teens about money, whether they are in boarding school or not. Do not ask for shopping lists at the beginning of the term, give them a budget to work with instead, and amounts that call for some trade off, between the essentials they need (lotion, pens, writing books etc), and the fun things they would want to have.

This approach could also be useful in home shopping. Instead of picking everything they want, how about doing home budgeting together, where you tell them how much money is available, and they then draft a budget, which they use to shop.

It takes work on your part, but they will thank you later. What important lessons did your parents practically teach you about money? Let’s discuss on the comments section, and on Twitter.

1 Comment