NSSF To Kenyan Worker, “More Please!”

Mr Kamau: Woow! What a beautiful flat you have built Mrs Otieno. Retirement is certainly going well for you. Share the secret. (Kenyans love to know the secret to wealth and success)

Mrs Otieno: (smiling) There is no secret Kamau. I started saving with National Social Security Fund (NSSF) when I first got employed at 22 years old, and last year when I retired, they paid me a huge lump sum. My money had been growing at 12% and it was amazing how much it had grown over 30 years. That’s what I used to build this rental house, I am now settled in old age as I have an income.

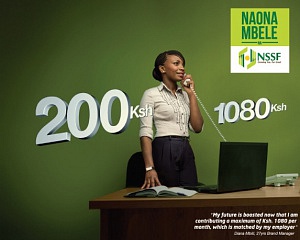

This conversation did not happen. No one talks in complete sentences like that. In NSSF advertisements however, the sentence construction is as fake as the content of said adverts. I haven’t heard of anyone who got a substantial payment from NSSF, I definitely haven’t seen retirees building flats around town have you? The fact that we get nothing much from NSSF does not really matter because at Kshs 400 monthly, the total contribution comes to Kshs 144,000 over a 30 year working life. It is not enough to keep you up at night.

However from this month with the NSSF Act 2013 taking effect, NSSF contributions are going to be significant for most Kenyans. The Act increases the minimum contribution to Kshs 750, and maximum to KShs 2,160 by the employee and matched by the employer. To make matters worse, the NSSF board now wants to include fixed allowances in calculation of pensionable pay. This means that if your employer gives you a fixed commuter, house or telephone allowance, this will count as “basic wages” according to NSSF, increasing your contribution if it is currently less than the maximum. They are also coming after casual workers.

I have nothing against saving for retirement, but I have a problem giving NSSF my money. In my opinion, the 400 bob we are currently contributing to NSSF is already too much money gone down the drain. NSSF is not competent to handle employee’s retirement funds for several reasons.

The fund, which has nearly Sh125 billion of workers’ money, is tainted by mega corruption scandals which have lost the fund billions of shillings. The most recent scandal involves the Kshs 5 billion Tassia Estate project where Kshs 11.4 million is said to have been spent on a project before any feasibility studies were conducted. The jury is still out on whether the project was feasible or not. In another recent scandal, the organisation sank over Sh3 billion in dubious contracts and land deals. It bought land in Karura and Ngong forests yet they are gazetted forests.

The fund has in the past also bought shares through the collapsed stockbroker Discount Securities, where it is bound to lose an estimated Sh1.5 billion. These are a few of the many scandals.

Such high level corruption is able to flourish within the fund because the senior management positions are held not on the basis of professional qualifications but political patronage. The appointment of the management trustee is a politically charged process, and dismissals have also been as political. Between July 2012 and April 2013, NSSF had 3 CEOs; Tom Odongo (who was sacked by the Minister of Labour Kazungu Kambi), Hope Mwashumbe (who held office for 5 months) and now Tom Odongo who is said to have been appointed in accordance to procedure by the board of trustees The NSSF board of trustees is appointed by the Minister of Labour and we know how ministerial appointments are done in Kenya. His tenure is not secure, and I bet that by the end of this year there will be yet another new CEO.

With such murk, it is therefore no surprise that NSSF has historically recorded an average return of 5% on savings which is much lower than the inflation rate meaning it has been losing contributors’ money. This rate of return is also much lower than what private pension funds have returned to their investors.

Unlike other pension funds, NSSF is not governed by the Retirement Benefits Authority because it is believed to be under the strict watch of the government. I also find it ironical that the government itself does not make any contributions to NSSF on behalf of civil servants and it was supposed to establish its own pension scheme which it has not 5 years later. As such, the government has no interest in ensuring that NSSF is managing funds prudently.

Looking at the above issues, a lot of questions arise:

Why are we then giving NSSF more money if it hasn’t managed what it has competently?

Why not mandate participation in a pension scheme, then let employees determine where best to save for retirement; with NSSF or other registered pension schemes?

Why not open up the field for all pension schemes (private registered funds and NSSF) to compete, then the best pension fund wins based on returns and management competence?

Who is looking after employee welfare within NSSF, since the government clearly isn’t?

Most importantly, what can we as employees do to protect our interests?

The NSSF Act 2013 provides an “out” for employers who are already contributing to registered pension schemes. They can apply for exemption from “Tier II” contributions and they contribute only the minimum, which is still much higher than what they are currently contributing. That is one way to minimize the “damage”. The second would be to demand more accountability for taxpayer funds which is far-fetched considering the low level of accountability we demand for the 30%+ we already pay in taxes.

3 Comments